Business Insurance in and around San Jose

San Jose! Look no further for small business insurance.

No funny business here

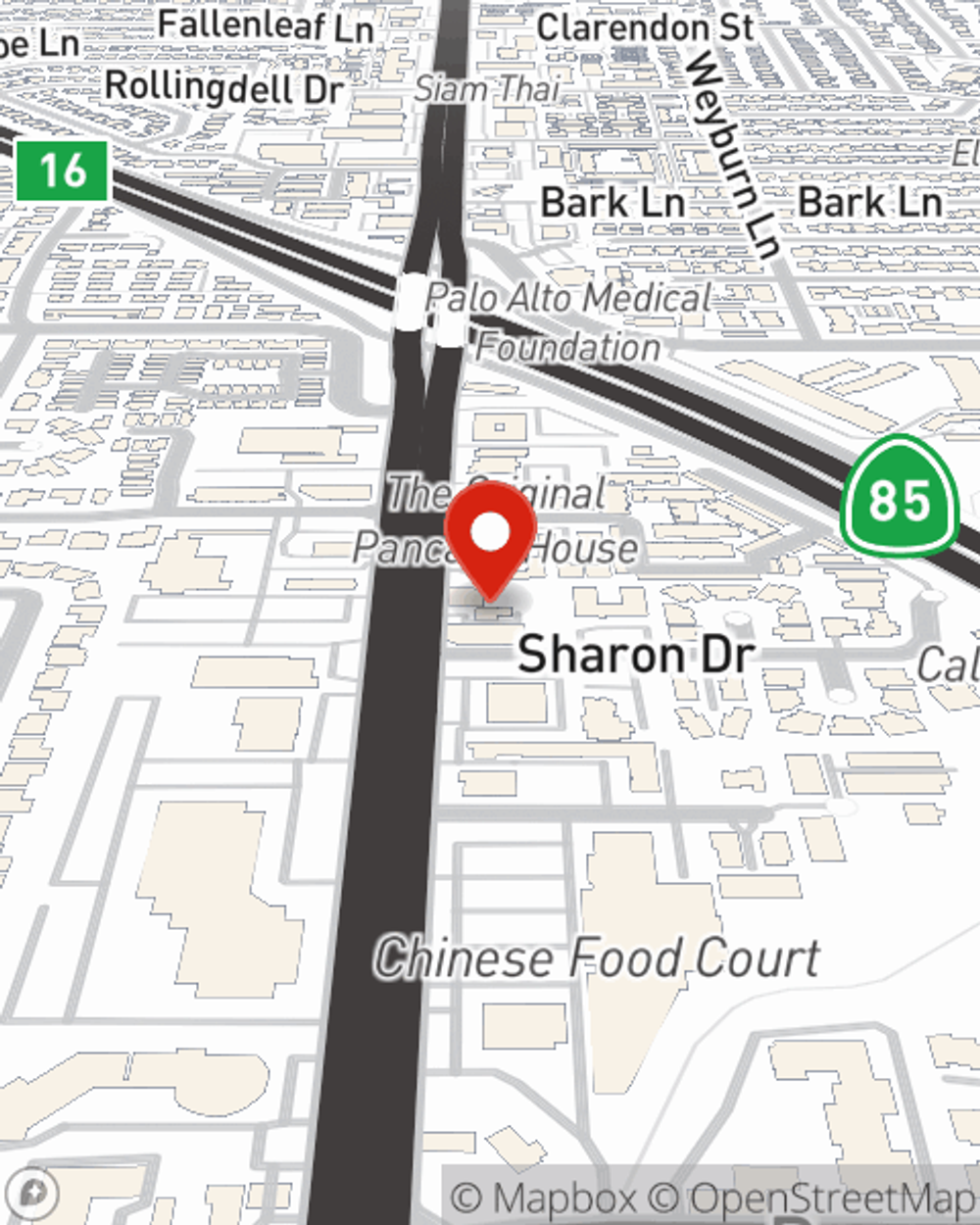

- Saratoga

- Cupertino

- Los Gatos

- Monte Sereno

- Sunnyvale

- Santa Clara County

- Santa Cruz County

- San Mateo County

- Bay Area

- California

Your Search For Excellent Small Business Insurance Ends Now.

It takes courage to start your own business, and it also takes courage to admit when you might need support. State Farm is here to help with your business insurance needs. With options like extra liability coverage, worker's compensation for your employees and a surety or fidelity bond, you can feel secure knowing that your small business is properly protected.

San Jose! Look no further for small business insurance.

No funny business here

Protect Your Business With State Farm

At State Farm, apply for the great coverage you may need for your business, whether it's a window treatment store, a lawn care service business or a floral shop. Agent Paul Middleton is also a business owner and understands your needs. Not only that, but exceptional service is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

Ready to review the business insurance options that may be right for you? Get in touch with agent Paul Middleton's office to get started!

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Paul Middleton

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.