Condo Insurance in and around San Jose

San Jose! Look no further for condo insurance

Condo insurance that helps you check all the boxes

- Saratoga

- Cupertino

- Los Gatos

- Monte Sereno

- Sunnyvale

- Santa Clara County

- Santa Cruz County

- San Mateo County

- Bay Area

- California

Condo Sweet Condo Starts With State Farm

Because your condo is your home base, there are some key details to consider - size, home layout, future needs, and making sure you have the right protection for your home in case of the unexpected. That's where State Farm comes in to offer you outstanding insurance options to help meet your needs.

San Jose! Look no further for condo insurance

Condo insurance that helps you check all the boxes

State Farm Can Insure Your Condominium, Too

Your home is more than just a roof and four walls. It's a refuge for you and your loved ones, full of your personal property with both sentimental and monetary value. It’s all the memories attached to every room. Doing what you can to help keep it safe just makes sense! And one of the most reasonable things you can do is getting a Condominium Unitowners policy from State Farm. This protection helps cover a plethora of home-related problems. For example, what if a fire damages your unit or lightning strikes your unit? Despite the annoyance or emotional turmoil from the experience, you'll at least have some comfort knowing your State Farm Condominium Unitowners policy that may help. You can work with Agent Paul Middleton who can help you file a claim to help assist replacing your lost items. Preparing doesn’t stop troubles from crossing your path. Coverage from State Farm can help get your condo back to its sweet spot.

Finding the right coverage for your condominium is made easy with State Farm. There is no better time than today to call or email agent Paul Middleton and learn more about your wonderful options.

Have More Questions About Condo Unitowners Insurance?

Call Paul at (408) 255-8061 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

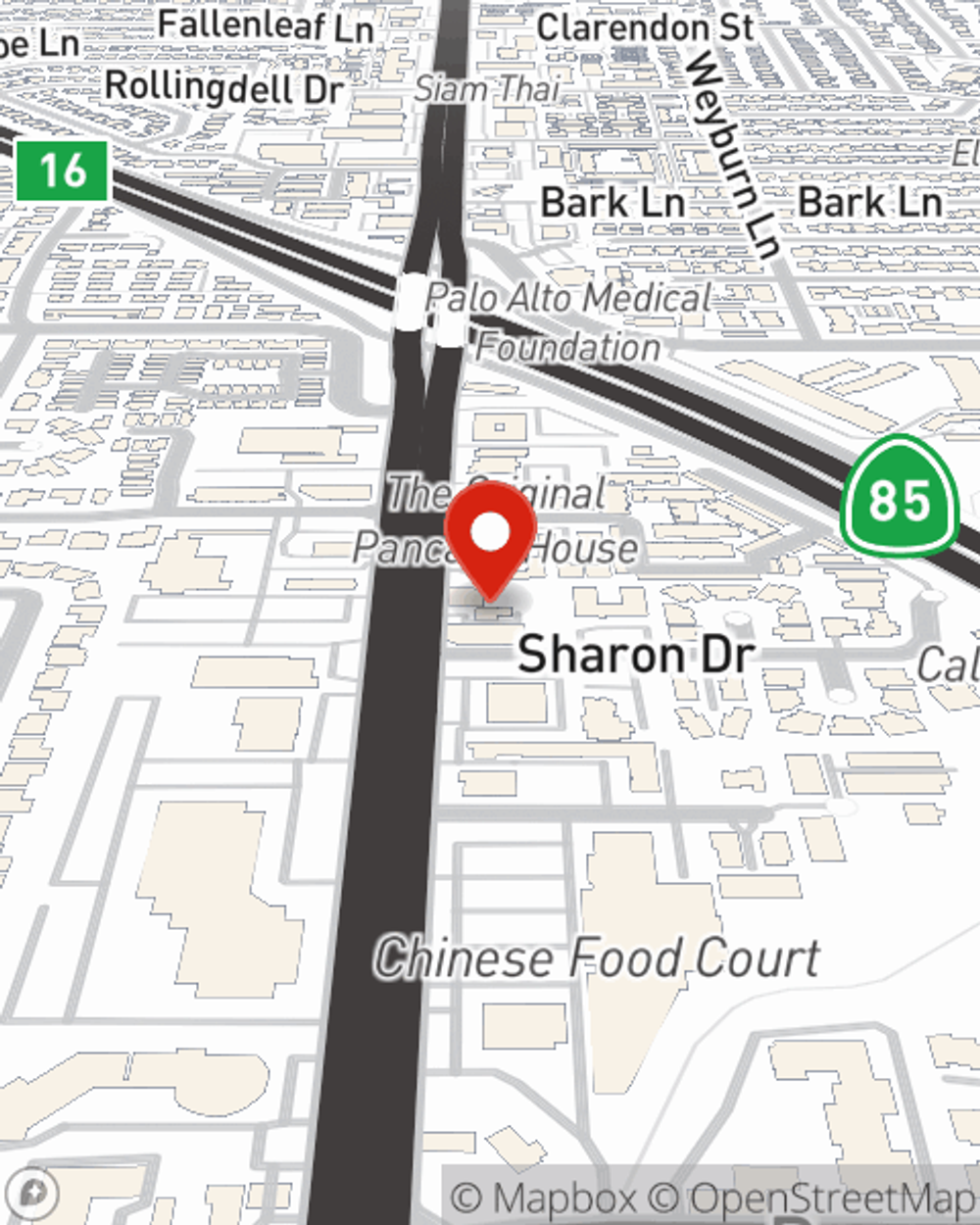

Paul Middleton

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.